by Nycole Walsh

As 2023 draws to a close, our team here at Kickstand is taking inventory of a pretty tumultuous twelve months. Anyone working in tech PR or marketing can tell you that this has been the year of “doing more with less,” and for us, one of the things this meant was scaling back our holiday celebrations from a larger company event to more intimate distributed team gatherings.

It got us thinking: how are other companies navigating their holiday celebrations after a year marked by economic turbulence?

To answer this question, we surveyed 608 full-time office workers in management roles or higher, and here’s what we found.

A Year of Challenges

2023 was decidedly difficult for many companies. Our survey indicated that:

- 36% of companies experienced a turbulent year

- 27% reported missed company revenue goals

- 24% saw an overall revenue decline compared to last year

- 23% faced layoffs

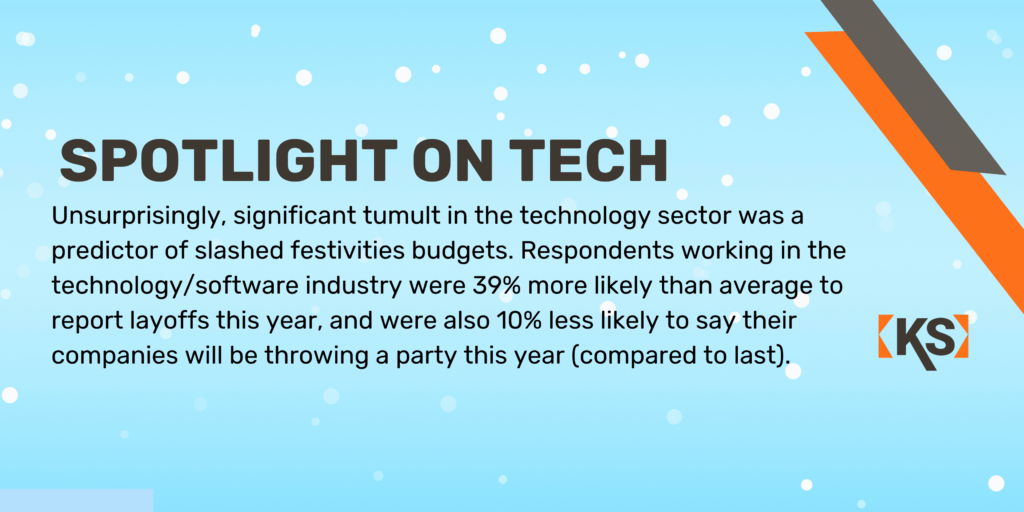

But some sectors felt the challenges more keenly than others. Respondents working in manufacturing were 28% more likely than average to report a turbulent year within their company, while those working in finance/banking or at enterprise level companies were both 17% more likely than average to say the same.

And those who reported a tranquil 2023 might just be lacking visibility, as respondents in senior leadership roles were 100% more likely than average to report missed revenue targets and 125% more likely than average to report a decline in YoY revenue – painting a somewhat less rosy picture than that of their counterparts in more junior roles.

Scaling Back on Celebrations

So while 71% of respondents partied with their colleagues last year, many are opting for a more muted holiday season in 2023 – in fact, 19% of respondents said their company is doing less to celebrate this year than last, with 24% cutting the celebration entirely.

Why the festive freeze this holiday season? 6 of every 10 respondents whose companies aren’t holding any celebrations this year blame financial woes and/or budget cuts, making it the most influential factor by a wide margin – more than 114% more likely to be selected than the next most common reason.

For those companies that are celebrating, 76% will throw an office party while 13% are opting for a virtual event. Some other ways companies are choosing to mark the occasion:

- Holiday bonuses or incentives (36%)

- Gift exchange (32%)

- Awards ceremony or recognition event (22%)

- Charitable activities and/or donations (14%)

- Costumed event (8%)

- Flying employees in from out of town (3%)

The Emotional Impact

To some, the absence of a holiday celebration with colleagues feels like much more than just a missed party; on the contrary, it can have a tangible impact on employee morale and retention. Of those whose companies will not be celebrating this year:

- 32% say this negatively impacts their job satisfaction

- 29% cite a negative effect on their connection to coworkers, and men were 46% more likely than women to say this

- 1 in 5 even reported a decreased desire to stay with their current employer

The Reason for the Season

Our survey made one thing clear: these gatherings are much more than just parties. They’re highly anticipated opportunities for bonding, and they’re vital to keeping teams connected and productive all year long.

Looking forward, companies should keep this in mind and creatively adapt during tough times. Even when grand parties aren’t feasible, smaller gestures of recognition and virtual events can help keep the festive spirit alive. Simple acts can help maintain a sense of belonging and show employees they’re valued – particularly in challenging times.

The Austin team celebrating in high style

The Boston team and a furry friend!

Moving into 2024, let’s remember that the power of simple togetherness is no small thing – it’s everything. Happy holidays from the entire team here at Kickstand!

Survey Methodology: Kickstand conducted an online survey of 608 individuals between December 2nd and December 14th 2023, at 95% confidence with +/- 4% margin of error. Respondents were restricted to US-based office workers employed full-time in management level or higher positions. Response representation ranged across 48 of 50 states, excluding North Dakota and Wyoming, and the highest volume of responses by industry came from Technology and Software (19.4%), Finance and Banking (13.7%), and Healthcare and Pharmaceuticals (9.1%).